i was not the f✶cking one.

⚠️ legal notice + survivor disclosure ⚠️

this site documents my real-time survival as a domestic violence victim, whistleblower, and single mom—samantha lowe. i am currently navigating active safety threats, institutional neglect, and retaliatory surveillance.

i’ve tried to handle this privately.

i was ignored.

if you are accessing this site in a legal, professional, or retaliatory capacity, you are on notice: this may constitute constructive misconduct, witness intimidation, or bad faith surveillance of a protected party.

i am the only person protecting my child.

i am the only person protecting myself.

i’m not being dramatic—i’m being thorough.

this is what survival looks like when no one steps in.

i see you.

and i’m documenting back.

✖ breach, babe

aka: how they kept him “retained,” kept me in the dark, and kept cashing my money

this isn’t vibes. this is ongoing breach.

they retained my husband for office optics, excluded me from status/ownership/billing clarity, concealed the advisor conflict, and kept drafting my account while i was postpartum and fleeing dv. that’s not compliance; that’s a machine built to multiply harm.

✶ the core thesis

they knew or should have known:

he was being “retained” without production, while i was funding the household.

the assigned rep (jess) had a personal/financial tie to him that compromised my file. (if literally any compliance happened)

i was mid-delivering a baby (jan 2024), mid-move, and in a documented dv crisis.

and they still:

treated me as payor when billing suited them, “non-owner” when disclosure was required.

ran medical intake (sep–oct 2023), paramed in my home (oct 2023), underwriting (feb 2024), and billing (through 2025) without coherent disclosures.

reassigned/rotated reps and never gave a straight ownership/beneficiary status update, then tried to sell me a fresh policy for new commission.

translation: conflict concealment + servicing interference + negligent retention = ongoing breach.

✖ the receipts they already know about (no spoilers)

known emails/letters in my name (already in the record):

sep–oct 2023: medical intake + nurse at my condo (paramed exam) → health data captured under their process.

jan 12, 2024: fror assignment + medical history questionnaire sent to me.

jan 23–28, 2024: adult e-sign packets (both adults).

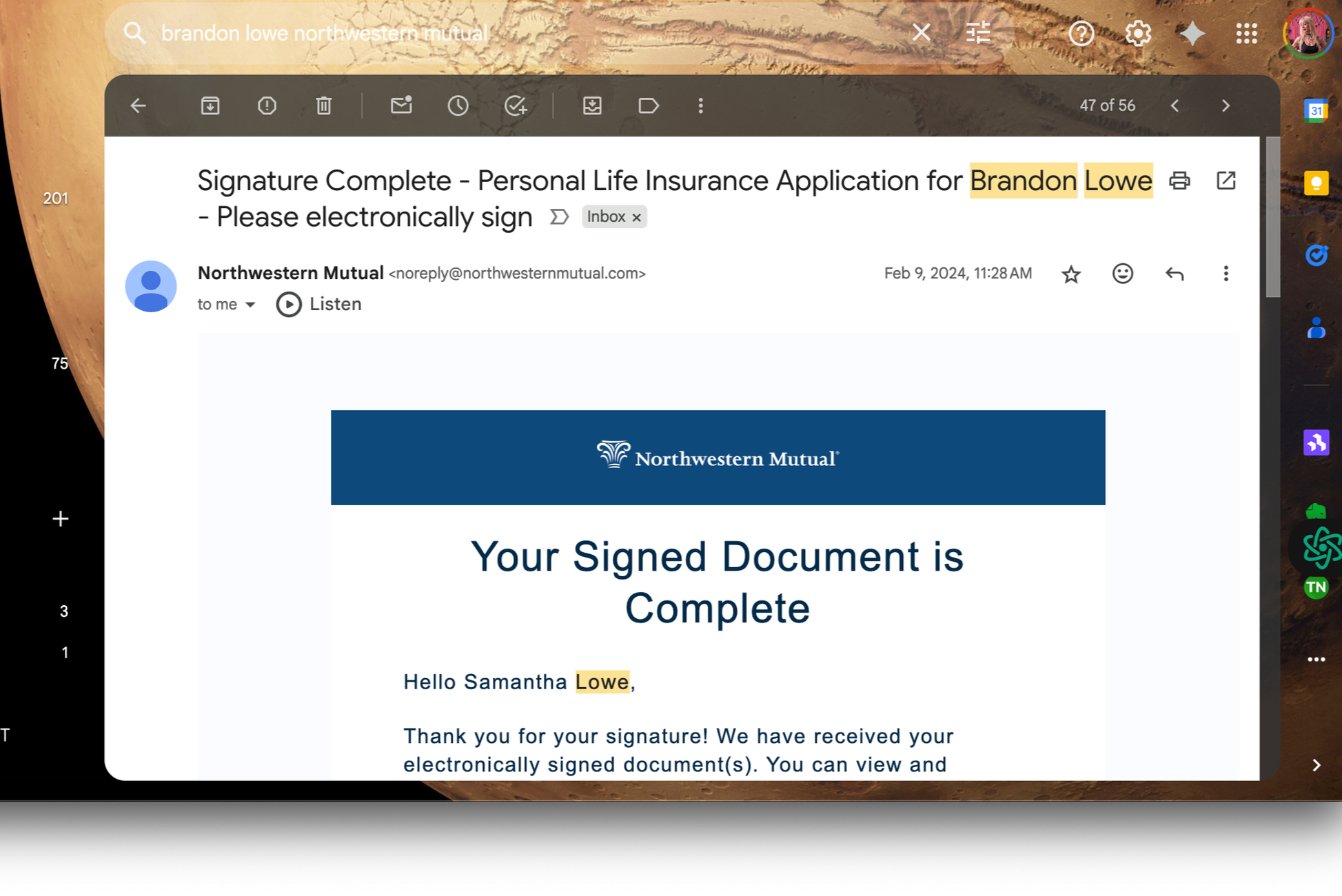

feb 9, 2024: “welcome to underwriting” with draft schedule; rep listed.

apr 18, 2024: “you are a client of jessica tenenbaum.”

mar 25, 2025: bill lists payer: samantha lowe (husband policy).

may 28, 2025: new child policy issued to me as owner/payer.

jun 10, 2025: post-lapse letter: “keep this coverage from ending.”

none of this is hypothetical. it’s their mail, their timestamps, their admissions.

✖ the ongoing breaches (aimed right at the conduct)

1) conflict concealment while “retaining” him

kept him “in the office”/in the ecosystem while an advisor with a personal tie sat on my file. no upfront conflict disclosure; no mitigation; no reassignment to a neutral rep during dv.

law: reg bi (rel. no. 34-86031) (conflict disclosure/mitigation); finra 3110 (supervision).

2) medical + financial data processing without coherent status

ran medical intake (forms + nurse), underwriting, and draft schedules while refusing to treat me as a client for disclosures. privacy when convenient, “not a client” when accountable.

law: glba; reg s-p (17 c.f.r. pt 248); restatement (3d) agency § 8.11 (duty of care with custody of info).

3) billing me as payor while blocking me as “non-owner”

post-lapse billing letters and payer-of-record designations against “no rights” narratives. choose a reality.

law: c.r.s. § 10-3-1104 (unfair insurance practices); finra 3110(b) (written comms supervision); contracts § 90 (promissory estoppel).

4) ownership/beneficiary manipulations without notice

status changes (ownership/beneficiary/rep) with no instrument or timely notice, during dv and postpartum chaos.

law: c.r.s. § 10-3-111 (unauthorized alteration); deceptive practices c.r.s. § 6-1-105(1)(e).

5) negligent supervision & retention

allowing off-channel dynamics, late-night “mentoring,” and rep overlap to govern my life insurance while i was paying everything and begging for clarity.

law: finra 3110; restatement (3d) agency § 7.07 (firm liability for agents).

6) retaliation by obstruction

after dv disclosures/protective orders, i get portal shrinkage, rep musical chairs, and a “new policy pitch” instead of remediation.

law: c.r.s. § 13-21-131 (retaliation vs crime victims); whistleblower anti-retaliation principles (15 u.s.c. § 78u-6(h)).

✖ the feb 9 email (context that matters)

date: feb 9, 2024 — two weeks postpartum.

state: relocating, funding everything, reporting dv, still being billed, still in underwriting pipelines.

firm behavior: assign/keep conflicted rep on my file; continue underwriting/billing; later claim i “never owned” two policies (while my name sits on the payment trail).

ownership doesn’t change by vibes. it changes by signatures.

✖ breach statement

they excluded me when disclosure would cost them,

included me when billing would pay them,

and retained him to keep the optics alive while my life burned.

that is not an administrative mistake.

that is breach — of privacy, of servicing honesty, of supervision, and of basic loyalty.

✖ glossary (why this matters)

material fact = anything that would change a reasonable person’s decision to buy, fund, or keep a policy. conflicts, ownership, beneficiaries, lapse status, who your rep is — always material. hide it? that’s misrepresentation.

fiduciary = when someone handles your money/health data/contract logistics and owes you loyalty, care, disclosure, and accountability. you don’t get to be “client” at billing and “stranger” at disclosure. pick one.

✶ disclaimer / correction lane

this page uses documents and facts already known to all parties. i’m not posting sealed materials or new surprises here. if anything stated is inaccurate, send documentation to sam.vetrano@gmail.com and i’ll correct it.

(so now, explain below)

★

northwestern mutual says this man owns all our family policies…but this is what he’s doing at that exact time:

date: 01/20/2025: relevance? five days before his daughter’s first birthday. he makes zero attempt to contact her.

the same week he skipped his court hearing and lost parental rights.

the same month northwestern mutual started to claim two out of three of our family policies — not his, not our child’s — belonged to me.

i signed and paid for everything. i was still paying.

they blocked my payments, let two policies lapse, and still listed him as the “owner”… while he was already in texas, getting drunk and playing house with someone else.

my northwestern financial rep, jessica tenenbaum put my husband — a man who was unemployed at the time and spending most of his days in her personal presence and her private home, unsupervised—as the owner for the policies she put under my bank account.

northwestern mutual kept that setup in place while my husband was living a secret second life in texas — married on paper, retaining all dependent pay for our baby; but publicly building a new one — and completely abandoning the child he left behind.

they still insist he’s the “full owner” of the policies i paid for, signed for, and maintained, including the one written for the child he refuses to support.

i am not a lawyer.

(in fact, i kinda read slow)

my position & invitation to clarify: this page is not intended to harass, threaten, or incite others against anyone. it is a factual record, based on documentation and witness statements, created because there is no professional contact channel left open. if any fact stated here is wrong, i want it corrected — immediately.

if anyone involved provides documentation disproving any point, i will update this record. please email me at: sam.vetrano@gmail.com for corrections.

✶ casefile: breach, babe

sam lowe (plaintiff)

vs.

northwestern mutual et al.

filed under:

the part where they assigned my husband’s work girlfriend to manage my finances during an active domestic violence emergency, erased me, failed to disclose a conflict, and then acted confused when i got litigious.

★statement of case★

northwestern mutual’s deliberate silence and concealment did not merely protect an employee’s misconduct—it prolonged an active cycle of domestic violence and enabled my financial destruction.

by representing the relationship between my assigned financial representative, jessica tenenbaum, and my husband as purely professional, the firm induced me to remain financially and legally bound to a marriage characterized by coercion, financial exploitation, and physical violence.

had the conflict of interest been disclosed at any time while tenenbaum was simultaneously:

serving as my financial representative of record,

maintaining personal and financial contact with my husband, and

exercising control over my financial and medical information,

i would have severed financial ties immediately and secured independent protection for myself and my child.

instead, disclosure came only after i had fled across the country, secured a restraining order, and begun rebuilding a life following documented violence. by then, the harm was complete:

i had financed my husband’s employment and training within the firm;

i had been induced to sign and fund life-insurance policies during childbirth and post-assault recovery;

i was denied ownership of the policies i paid for;

my access and beneficiary rights were altered without consent or notice; and

the company continued to draft premiums from my account under a protective order.

northwestern mutual’s post-hoc admission of an “awkward personal relationship” between advisor and spouse amounts to a retroactive confession of fiduciary breach. this was not clerical error. it was institutional betrayal that placed a documented victim of domestic violence at ongoing financial, emotional, and physical risk.

★causes of action (non-exhaustive)★

Breach of Fiduciary Duty — multiple counts arising from failure to disclose advisor conflict, misuse of confidential medical and financial data, and continued billing after notice of abuse.

Constructive Fraud — C.R.S. § 13-21-102; inducement to sign contracts under duress and deception.

Negligent Supervision & Retention — failure of compliance, legal, and supervisory staff to investigate obvious red flags and stop conflicted advisor activity.

Aiding & Abetting Domestic Violence — C.R.S. § 18-1-603; knowing facilitation of financial access and concealment of information from a protected party.

Intentional Infliction of Emotional Distress — extreme and outrageous conduct performed with reckless disregard for foreseeable harm to a DV survivor.

Unjust Enrichment — retention of premiums and commissions obtained through fraudulent inducement.

Retaliation After DV Disclosure — C.R.S. §§ 13-21-131 & 18-8-706; suppression of service, exclusion from portal access, and obstruction of complaint process after protected disclosures.

Unauthorized Alteration of Ownership & Beneficiary Rights — C.R.S. § 10-3-111; changes executed without consent while plaintiff remained payor of record.

Unfair Insurance Practices — C.R.S. § 10-3-1104; misrepresentation of policy terms, failure to acknowledge communications, and deceptive omission of conflict information.

★requested relief (summary form)★

compensatory and treble damages as provided by statute;

disgorgement of commissions and premiums;

declaratory judgment voiding fraudulent policies;

injunctive relief requiring disclosure and reform of conflict-of-interest protocols;

punitive damages under C.R.S. § 13-21-102(1)(a);

attorney’s fees and costs.

fucking justice.

★translation for normal people:

this wasn’t a misunderstanding. it was a corporation’s choice to side with an abuser and his office fling over a pregnant client, a legal fiduciary duty, and basic human ethics.

★disclaimer:

i am not a lawyer.

i’ve taken some intro law classes and learned enough to know this is beyond fucked. i’m doing this because i literally have to—no other choice.

*all statements here are based on documented facts and firsthand records.

“they fucked around and forgot they were fucking fiduciaries.”

✶

a fiduciary is someone who has a legal obligation to act in the best interest of another person. not just "try their best" or "be nice" — legally bound to put your interests first. even above their own.

it's a relationship built on trust, vulnerability, and power imbalance.

so the law treats it seriously.

legally, this means they must:

act loyally → they can’t secretly favor someone else, especially someone paying them or sleeping with them.

act carefully → they have to know what they’re doing, and do it responsibly.

disclose conflicts → anything that could compromise their judgment has to be shared up front.

avoid self-dealing → they can’t use your account or situation to benefit themselves or their little office clique.

be accountable → they must document and explain decisions, especially around money

✶

what is a fucking fudiciary?

what they owed me,

☠︎ legally ☠︎

(aka: “lol, nope”)

✶ duty of loyalty

→ financial reps are required to act in the best interest of the client.

Restatement (Third) of Agency §§ 8.01–8.03

also basic ethics, but whatever lol

✶ duty of care

→ advisors must act with the care, skill, and diligence that a reasonably prudent person would exercise.

see: literally any fiduciary standard ever written

✶ duty of disclosure

→ material conflicts of interest must be disclosed.

→ such as:

• private payments

• off-platform contact

• strategic personal ties

• weird “awkward” relationships

C.R.S. § 10-3-1104 (Unfair Insurance Practices)

✶ duty to account

→ premium payments made by the client must be properly tracked and applied.

→ the person paying should remain… involved.

C.R.S. § 10-2-704 (Fiduciary Funds Rule)

also known as: don’t steal from your client, bro

✶ duty to mitigate conflicts

→ firms must identify and mitigate advisor-client conflicts under SEC Reg BI.

Reg BI Release No. 34–86031, FINRA Rule 3270

✶ duty to notify

→ if policy ownership, beneficiary status, or advisory representation changes, the client should be told.

→ lol

C.R.S. § 10-3-111 (Unauthorized Alteration of Contracts)

lol ok

✶ duty not to retaliate

→ firms are not allowed to retaliate against clients who raise concerns, especially related to abuse or fraud.

→ also: dumb.

15 U.S.C. § 78u-6(h)(1)(A) (SEC Whistleblower Protection)

C.R.S. § 13-21-131 (Retaliation Against Crime Victims)

✶ material fact 101

(finance + insurance sales edition)

➤ definition (plain):

a material fact = any piece of information that would matter to a reasonable client when deciding whether to buy, sign, fund, or stay in a financial product or service.

if it would change your decision → it’s material.

✶ in finance/insurance:

ownership: who actually owns the policy/account.

beneficiaries: who gets the payout if you die.

conflicts: whether your “advisor” is secretly tied to your spouse, your abuser, or has skin in the fucking game.

compensation: how they get paid (commission, bonus, override).

performance: whether the product is lapsing, underperforming, or never actually paying out.

status changes: whether your advisor is removed/reassigned — because that changes who owes you fiduciary loyalty.

disclosures: medical history, criminal record, financial vulnerability. if they know it, they must handle it with care.

✶ legal test (for juries):

would an ordinary person, in your shoes, say:

“if i’d known that, i would’ve acted differently”?

→ if yes, then it’s material.

✶ why it matters in insurance sales:

agents can’t hide conflicts (like fucking with your spouse).

firms can’t “forget” to tell you when they swap your advisor.

reps can’t bury venmo payments, bonus schemes, or lapses.

beneficiaries/ownership structures are always material

because they control who profits from your death.

⚖️ closer:

material facts aren’t optional. if it changes your decision to buy or keep a product, they have to disclose it.

hiding it = misrepresentation.

i almost died.

northwestern mutual denver knowingly (or absolutely should have known) assigned a financially conflicted office goblin—who was venmoing my husband and facetiming him through dv—to advise me on life insurance while i was nine months pregnant, funding everything alone, and dodging strangulation attempts.

bro—they let her onboard me, kept her assigned to our family’s file while i paid every single premium—his policy, my policy, our baby’s. and then? they let him remove me as his beneficiary, ghosted my ownership of the child’s policy, and later claimed—on record—that i was “never the owner” of either, just “the payer.” like that’s legally meaningless.

my guy—is this not your job? why did i have to look up the law to know an entire financial fucking firm was screwing me?

yo, y’all are fired. terrible work.

for real this shit is run like fudiciaries for dummies—i submitted my kid’s medical paperwork, got confirmation emails in my name, paid $200+ in january alone to ensure the policies remained active, received payment reminders from them in february, and was actively discussing billing with my new rep the whole time. if you accept my money, confirm receipt, and bill me again—i have rights.

wtf? again—my fiduciaries, why am i doing your job?

you don’t get to pocket the cash and pretend i was never here. but that’s exactly what they did. and when i asked for answers? bro—they’re hitting me with “your rep is on PTO, so kindly fuck off”

my guy—

this wasn’t a misunderstanding.it was coordinated policy sabotage during a domestic violence crisis by a firm that ran its compliance department like a frat basement.

and when i reported my shitshow? babe—they called me hostile. yo, i didn’t lose access—i was financially fucked by fiduciary clowns who mistook nepotism for ethics and forgot that i keep receipts and file federal complaints for fun.

why am i mad?

if i find out this firm or my reps aided and abetted in my near-death experience and financial ruin?

(while internally mocking me as i bought policies?)

lol.

(!!!!!!!!!!!!!)

i’m gunna burn

everything

fucking

down.

(figuratively)

because we almost fucking died

!!!!!!!!!!!!!

current status?

*unconfirmed

i want it to be said

so fucking loudly:

this is what potentially happens when firms normalize in-office fucking trysts as “team bonding,” forget they’re fucking fiduciaries, fail to supervise shit, and hand over financial control to someone emotionally emeshed with your legal husband while you’re being increasingly beaten and paying every bill.

listen: they do not give, a single fuck.

they oversaw a pregnant woman get financially devastated, physically assaulted, and quietly erased from her own legal documents—even after she reported it.

and babe—they still somehow appear to think they have done nothing wrong. like fucking toddlers with access to bank accounts.

✶ sec whistleblower disclaimer ✶

pursuant to the dodd-frank wall street reform

and consumer protection act (15 u.s.c. § 78u–6),

i, samantha lee lowe, am a registered whistleblower complainant

with the u.s. securities and exchange commission (sec).

as of july 2025,

i have formally submitted a tips, complaints, and referrals (tcr) filing,

documented under record id: [4026199040],

concerning potential violations of securities law

and fiduciary misconduct by representatives of northwestern mutual denver.

this disclosure is protected by:

15 u.s.c. § 78u–6(h) → anti-retaliation provision

rule 21f-2(b)(1) under the securities exchange act → confidential whistleblower status

colorado rev. stat. § 24-50.5-101, et seq. → state whistleblower protections

retaliation against a whistleblower—whether through defamation, professional sabotage, policy tampering, or legal harassment—is expressly prohibited under federal and state law.

attempts to intimidate, silence, threaten, or retaliate against me in connection with this report will be:

added to the official SEC record,

forwarded to relevant enforcement offices,

included in my civil filings, and

promptly made public.

this is no bullshit. it’s a protected disclosure.

your best response is compliance.

✶ legal release: redactions, intent & protected disclosures ✶

this page contains information related to my official SEC whistleblower complaint (TCR #17524-664-607-685) and accompanying civil claims involving fiduciary misconduct, financial exploitation, and policy tampering connected to my role as a client and protected party.

redactions

i have intentionally redacted or abbreviated names to first and last initials where feasible—not out of obligation, but as a baseline of decency for people who extended me none.

this is not revenge.

this is the public record of my survival, documented on my terms, in my voice.

intent

my intent is not:

to stalk, dox, harass, or incite action against any specific person

to endanger anyone’s safety, employment, or family

to manufacture rumors or knowingly misstate fact

my intent is:

to ensure this story is not suppressed by power or privilege

to prevent future clients, survivors, or vulnerable parties from falling into the same legal trap

to protect the integrity of my whistleblower status under federal law

to create an accountable timeline of events rooted in documentation, not deflection

legal protections

this disclosure is protected under:

15 U.S.C. § 78u–6(h) (Dodd-Frank whistleblower retaliation clause)

First Amendment (U.S. Const. amend. I)

Fair report privilege (Gertz v. Welch)

Truth defense (NYT v. Sullivan)

Anti-SLAPP statutes in Colorado, California, New York, Texas, and Florida

bottom line

if you’re named, it’s because you were documented.

if you're uncomfortable, take it up with your conscience—or your compliance team.

any attempt to retaliate against me, legally or otherwise, will be considered:

a violation of federal whistleblower law

an addendum to my SEC file

grounds for additional civil action

this isn’t personal.

this is evidence.

and it’s legally protected.

factual corrections?

please contact me asap!